Yet more on the plight of depositors and the blindness of regulators

The Bank of England has now published its resolution intentions. These incorporate the EU provisions under Directive 2014/59/EU introduced in May but largely overlooked by the media. This is all the more surprising since the directive introduces concepts that are entirely novel under English insolvency procedures and which further develop the principle set out in s.13 Financial Services (Banking Reform) Act 2013. That legislation (which you may recall from my previous posts) created a special priority for the banking industry when the FSCS has to pay out small depositors: their right to recover these payments from the failed institution is set ahead of all other unsecured claims. Those unsecured claims included larger deposits as well as those of normal unsecured creditors such as senior unsecured bondholders.

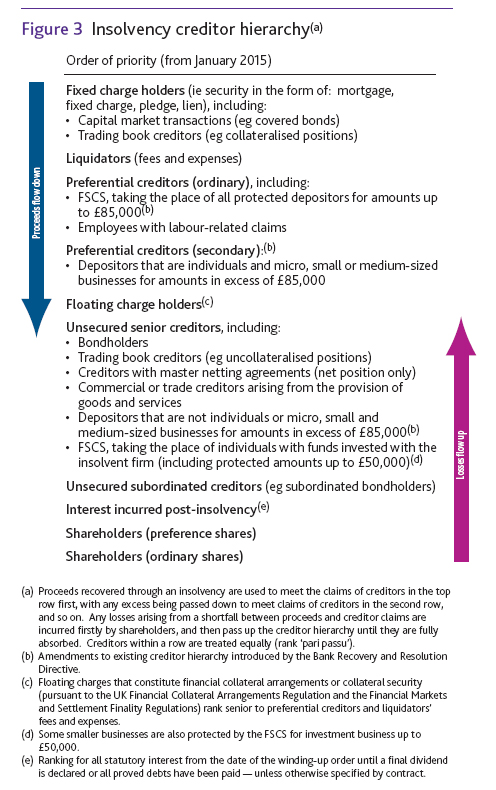

The new provisions (whihc take effect in January 2015) add the further complexity of an intermediate layer of preference to some but not all larger depositors: the relevant provisions are in Article 108 of the Directive and are summarised in the helpful Figure 3 on page 14 (nominal 16 of the pdf) of the BoE resolution document. The ranking of these deposits now depends on whether they are made by “natural persons and micro, small and medium-sized enterprises” or by larger companies. The former are preferred (but still below the “superpreferred” FSCS claims): the latter are not.

Precisely as I’d feared the position of larger depositors is thus very unsatisfactory, although I had not envisaged this extra degree of complexity. No doubt the idea of offering some level of preference to individuals is intended to avert irrational panic (and will enable politicians to claim disingenuously that they have protected all depositors who have votes, while the regulators will claim they have dealt with too big to fail), but will this really be the result in practice? And what about the all-too-rational panic that will grip corporate depositors once they understand their predicament, and who are likely to have far more momentum than the individual depositors?

Both classes of larger depositor are in effect subordinated to interbank lenders who have taken security (as almost all now do, particularly when a bank is likely to be heading towards resolution) as well as to the banking industry’s “superpreferred” FSCS subrogation rights. In practice this will mean a very much lower payout in insolvency than under the old regime (particularly if you go back a generation, when banks didn’t give security to fund themselves). Given that banks heading for default are likely to raise as much as they can using security before resolution steps are applied it is in practice quite possible that the secured and superpreferred creditors will eat up all the written-down assets leaving nothing for either the preferred or ordinary creditors. So larger depositors’ payouts (whether individual or corporate) will be completely aleatory and wholly outside their control or influence once the deposit is made, making a nonsense of the idea that banks’ behaviour can be disciplined by market forces. In fact the only people who are likely to have an inkling of what is going on are the banking counterparties who are totally insulated from risk.

The idea that depositors are now taking real credit exposure on individual banks (when those that understand the issues are not) raises serious issues of the allocation of responsibility. How can the public or even corporate depositors seriously be expected to assess the risk of banks on the basis of out of date accounts (mostly dressed up for the year-end window) when things change so rapidly just before default? Regulators with access to far better information cannot do this. This is an industry that is still allowed massive levels of leverage despite running business risks that are far higher than they should be, with a track record of cheating spurred by incentives to do so, regulated by people who think that the remuneration structure is the solution when it is the cause of many of these problems.

For the moment of course no one believes this. When you place a deposit with a bank you get exactly the same (lousy) rate whether you are an individual with £50,000, an individual with £500,000 or a corporate with either amount. That cannot be logical unless people continue to believe that the BofE paper is pure EU window-dressing and that in fact the Chancellor will always step in to protect all depositors: it’s just that Brussels won’t let us say so now.

Either way, this obfuscation is unacceptable. There will be panic next time, and it will be compounded by these daft provisions. I find it astonishing that this mess had not yet been exposed by the press.

Is this in principle different from any of the other contractual relationships that corporations enter into, assessing their counterparties on the basis of out of date accounts? I fully accept the need to protect private individuals, both for small individual deposits and occasional large balances, but I’m unpersuaded by the public policy case for protecting all depositors.

One argument you make is the iniquity of the secured nature of much inter-bank lending, but if a bank were really in trouble the first thing it would do would be to sell its most liquid assets. From the perspective of unsecured creditors, it matters not whether the bank’s inventory of bonds has been sold outright or sold with the obligation to repurchase.

The difference is that banks now have such huge leverage that they are much more likely to go bust without due warning. Once the pari passu principle is broken (which the Bank of England started to permit only about 20 years ago, and only because it felt too weak to oppose the banking sector) the market discipline of what other banks accept vanishes. No sane banker would lend to a corporate unsecured without a negative pledge, yet that is the proposition depositors are now forced to swallow. That is why it is different. And when the next crash happens you will find that the defaulting banks have not unwound the chains of hypothecated and rehypothecated assets, and that the settlement of these claims will make the Lehmans clean-up look simple. What does matter to the unsecured creditors is how many haircuts, realisation costs and consequential losses are piled onto the prior claims on the only saleable assets. There will in fact be a major difference for unsecured payouts under these proposals compared with pari passu provisions. But the real point is that the market is telling us one thing (ie that the government won’t dare apply these rules) while the regulators say another, and that isn’t a good basis for a thriving financial services industry.